In the spirit of fairness, Bolton Council will be included in a trial that will help local authorities recover unpaid council tax. As it it stands, the amount of unpaid council tax is currently costing local authorities tens of millions every year.

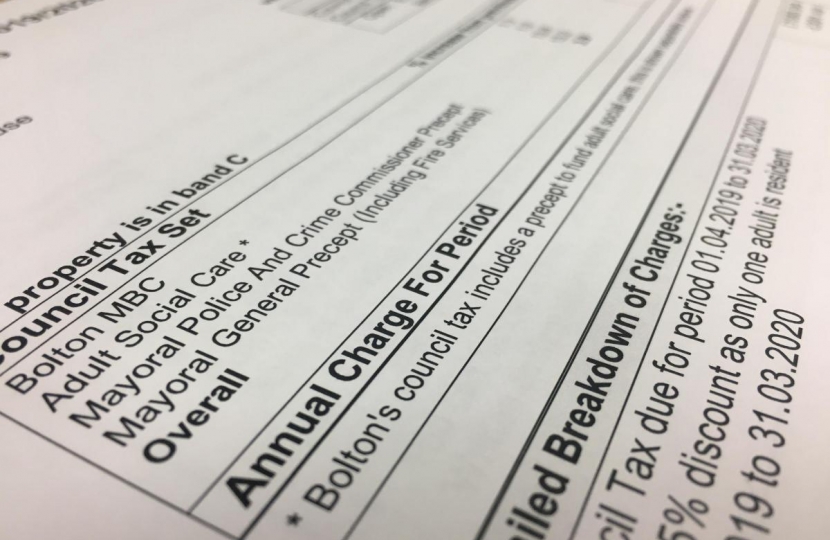

Around £5.5m worth of council tax was unpaid last year, taking the total to £15.92m altogether. We strongly believe that everyone has a right to basic frontline services in return for the council tax they pay but this can only be done when everyone plays by the rules.

This has all been made possible the introduction of the Digital Economy Act 2017 by the central Conservative government.

Councillor David Greenhalgh, the Leader of the Council said: “The vast majority of our residents pay their council tax every month, that helps to pay for vital services and to support some of our most vulnerable people.

“However, there are those who are avoiding paying council tax and despite our best efforts we have been unable to recover what they owe. We hope this pilot gives us the power to hold these people to account.

“Together with our partners in debt advice charities, we will continue to support those people who are struggling to make ends meet. Anyone who is struggling with their bill should get in touch with us straight away.”

Through the trial, non-paying customers who are employed or have an income will be contacted to start paying their debts, or they will have their debt deducted directly from their earnings through their employer - should they be in a financial position to do so. This is an ‘Attachment of Earnings’ and is commonly used to recover debt. However, if a person fails to or refuses to supply their employment details, councils have been unable to recover unpaid council tax using this method. The Digital Economy Act allows councils to obtain employer and income information from HMRC for people who have failed to pay their council tax and have an order to pay by the local magistrates’ court.